In the dynamic world of business, Startups plays a pivotal role in driving innovation, economic growth, and job creation. One of the fundamental pillars that support Startups ventures is adequate funding. The journey from idea to successful business requires financial resources, and understanding the diverse funding options available is essential for every aspiring Business Growing. In this guide, we will delve into the various business funding options, weigh their pros and cons, and provide insights to help New Business make informed decisions about their funding strategy.

What We'll Cover

Funding Options

Equity Financing

Equity financing involves raising capital by selling shares of your business to investors. Three prominent avenues for equity financing are:

- Venture Capital: Venture capitalists are professional investors who provide funding to startups and early-stage companies with high growth potential. In exchange for their investment, they acquire a share of ownership in the business.

- Angel Investors: Angel investors are individuals who invest their personal funds in startups in exchange for equity. They often bring not only financial resources but also valuable expertise and networks to the table.

- Crowdfunding: Crowdfunding systems enable Startup to raise modest sums of money from a large number of people, usually via online campaigns. This method democratizes investing and can aid in the validation of market interest.

Debt Financing

Debt financing involves borrowing money that must be repaid over time, usually with interest. Common avenues for debt financing include:

- Bank Loans: Traditional bank loans are a reliable source of capital for established businesses. These loans come with specific terms and interest rates based on the borrower's creditworthiness.

- Small Business Administration (SBA) Loans: SBA loans are government-backed loans designed to support small businesses. They offer favorable terms and lower down payments compared to conventional bank loans.

- Personal Loans: Startup can use personal loans to fund their businesses. However, this approach intertwines personal and business finances, which can be risky.

Self-Financing

Self-financing involves using your own savings or resources to fund your business. Two common self-financing strategies are:

- Bootstrapping: Bootstrapping involves starting and growing your business with minimal external funding. This approach allows you to maintain full control but might limit your growth potential.

- Personal Savings: Using personal savings to fund your venture provides financial autonomy but can deplete personal safety nets.

Alternative Funding

Several unconventional funding sources can be considered:

- Grants and Competitions: Many organizations offer grants or hold competitions that provide financial support to promising startups, often in specific industries or aligned with particular goals.

- Strategic Partnerships: Collaborating with larger companies can lead to strategic partnerships that offer funding, resources, and access to markets.

- Family and Friends: Borrowing from family and friends might be an option, but it should be approached with caution to preserve personal relationships.

Factors Influencing Funding Options

Choosing the right funding option depends on several factors:

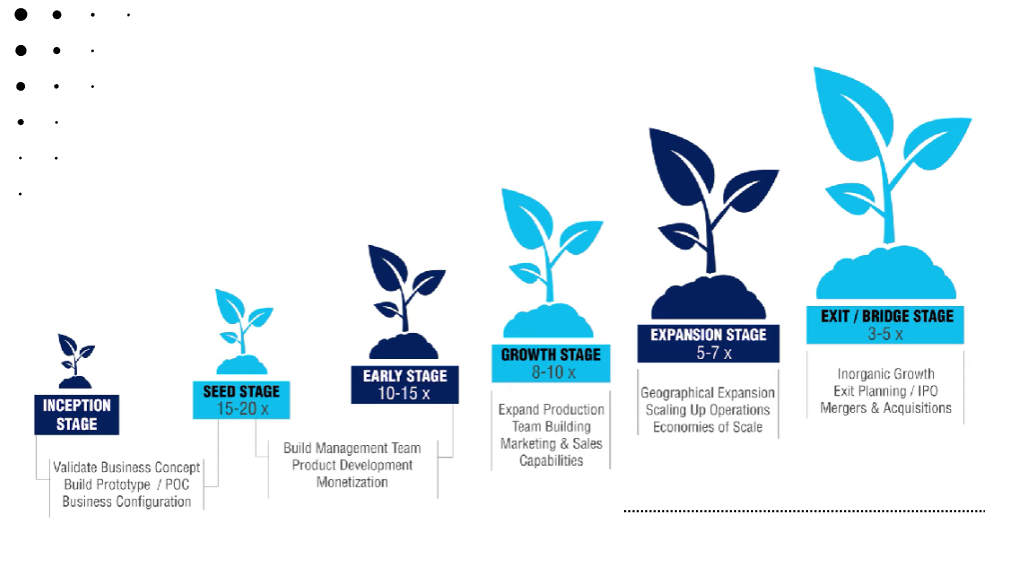

Business Stage and Growth Plans: Early-stage startups may lean toward equity financing, while more established businesses might opt for debt financing to fuel expansion.

Industry and Market Conditions: Certain industries attract specific types of investors. Market trends and competition also impact funding choices.

Risk Tolerance: Startup must assess their willingness to give up ownership (equity financing) or take on debt (debt financing) and balance it against potential rewards.

Ownership and Control Preferences: Startup should consider how much control they're willing to relinquish in exchange for external funding.

Pros and Cons of Each Funding Option

Each funding option comes with its own set of advantages and disadvantages:

- Access to expertise and networks, shared risk with investors

- Retain ownership and control, interest payments are tax-deductible

- Full ownership and control, no debt-related burdens

- Diverse funding sources, potential for non-monetary support

- Loss of ownership and control, pressure to meet investor expectations

- Obligation to repay regardless of business performance, potential for high interest costs

- Limited funding availability, potential strain on personal finances

- Competitive application processes, varied expectations from funders

Key Considerations for Startups

To navigate the funding landscape effectively:

Assessing Funding Needs: Calculate the exact amount needed to accomplish your business goals.

Building a Strong Business Plan: A well-structured business plan can instill confidence in potential investors or lenders.

Understanding Investor Expectations: Different investors have different expectations. Understand what they're looking for and how their involvement will affect your business.

Managing Financial Risk: Be prepared for the possibility that your business may not generate immediate profits. Ensure your financial strategy accounts for potential setbacks.

Case Studies

Real-world examples illustrate the successful implementation of various funding strategies:

- Company A secured venture capital funding, leading to rapid growth due to the investor's expertise and resources.

- Company B opted for bootstrapping, allowing them to retain complete control over their business direction and operations.

These case studies underscore the importance of aligning your funding strategy with your business goals and risk tolerance.

How to Choose the Right Funding Option

- Matching Funding Sources with Business Goals: Choose funding that aligns with your business trajectory and objectives.

- Balancing Risk and Reward: Consider the potential returns against the associated risks.

- Seeking Professional Advice: Consulting with financial advisors, legal experts, or mentors can provide valuable insights.

Emerging Trends in Startups Funding

- Impact of Technology and Fintech: Technological advancements are reshaping how Startups access and manage funds, with fintech platforms offering innovative funding solutions.

- Social and Environmental Startups: Funding sources increasingly favor businesses with a positive impact on society and the environment.

- Changes in Regulatory Environment: Stay informed about evolving regulations that could impact fundraising processes.

Conclusion

Mastering the art of securing the right funding is an essential skill for Startups. The path you choose should align with your business goals, risk tolerance, and growth aspirations. By understanding the diverse funding options available and weighing their pros and cons, you can embark on your Startups journey well-prepared to secure the financial resources necessary for your venture's success. Remember, a thoughtful funding strategy is a cornerstone of sustainable growth in the dynamic world of Startups.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.