The cryptocurrency market, reeling from the 2022 crash, continues to capture the attention of investors worldwide. But what exactly is cryptocurrency, and what lies ahead for this digital frontier?

What We'll Cover

- Current Challenges in the Cryptocurrency Realm

- Volatility and the Cryptocurrency Crash

- Criminality and Deception

- Security and Privacy Concerns

- Environmental Impact

- Responsibility, Regulation, and Oversight

- Why Do Investors Embrace Cryptocurrency?

- What to Understand Before Investing in Cryptocurrency

- What Is Cryptocurrency?

- Types of Cryptocurrencies

- How Does Cryptocurrency Work?

- How Is Cryptocurrency Utilized?

- Factors Influencing Cryptocurrency Prices

- Taxation of Cryptocurrency

- The Cryptocurrency Challenge

The 2022 cryptocurrency market crash has amplified ongoing concerns about its long-term viability, even as a persistent allure surrounds digital assets, attracting both curious onlookers and seasoned investors. It is crucial for anyone contemplating an investment in this space to cultivate a comprehensive understanding of the challenges and prospects inherent in the world of cryptocurrencies.

These challenges are substantial and multifaceted. The cryptocurrency realm has been punctuated by frenzied hype, speculative bubbles, and instances of fraudulent activity, all of which have artificially inflated the value of digital currencies. Moreover, the sector remains deficient in terms of fiduciary accountability, regulatory oversight, and environmental sustainability due to its energy-intensive computational processes, concerns shared by consumers and governments alike.

Nevertheless, a palpable optimism pervades among crypto enthusiasts. As of May 2023, the global cryptocurrency market capitalization had exceeded the remarkable milestone of $1 trillion. Equally captivating are the non-cryptocurrency applications stemming from the underlying blockchain technology, spanning diverse sectors such as healthcare, media, and supply chain management.

In this article, we delve into the controversies and crises that have marked the cryptocurrency landscape in recent years. Additionally, we furnish readers with a comprehensive perspective on the essence of cryptocurrency, its regulatory and accounting nuances, and the essential insights potential investors must grasp as they navigate the turbulence of this volatile domain.

Current Challenges in the Cryptocurrency Realm

A 2023 study by the Pew Research Foundation revealed that the majority of Americans harbor reservations regarding the safety and dependability of cryptocurrencies, even as ardent supporters remain vigilant against a backdrop of formidable challenges.

Volatility and the Cryptocurrency Crash

Cryptocurrencies, notorious for their price volatility, often become susceptible to scams. Even those touting stability and asset backing have succumbed to catastrophic collapses. In May 2022, TerraUSD and its associated algorithmic stablecoin, LUNA, plunged, causing a market-wide crypto meltdown and wiping out over $400 billion in investor wealth. Subsequently, in November of the same year, FTX, a major crypto exchange, experienced a disastrous crash due to liquidity issues, financial mismanagement, and a wave of panicky withdrawals, which adversely impacted the value of its native token, FTT, along with various other cryptocurrencies, including Bitcoin and Ethereum.

The performance of the CoinDesk Market Index from 2018 to 2023 displayed considerable fluctuations, plummeting in 2019, experiencing erratic surges in 2021 and 2022, and regressing to 2018 levels in 2023. This index, designed to gauge the market-capitalization-weighted performance of the digital asset market, serves as a barometer of the crypto market's tumultuous nature over the past five years.

The fallout from the FTX debacle had cascading repercussions on other major exchanges. BlockFi and Gemini's third-party lending partner, Genesis Global Capital, suspended withdrawals, while Crypto.com froze withdrawals of stablecoins USDC and Tether (USDT), both pegged to the US dollar. Additionally, Coinbase initiated significant layoffs, numbering nearly 1,000 employees, in response to the turmoil unleashed by the market crash.

The crash also cast a shadow over the NFT (Non-Fungible Token) market, where renowned NFTs like Bored Ape Yacht Club and CryptoPunks witnessed substantial price slashes in August 2022. Although the decline correlated with falling cryptocurrency prices, it was exacerbated by high-profile scams and market saturation.

The cryptocurrency realm had already weathered several crashes, including those in 2021, 2020, 2018, and 2013, primarily fueled by speculative fervor and media sensationalism. This recurring volatility underscores the inherent instability of cryptocurrencies while also showcasing their resilience.

Criminality and Deception

The year 2022 saw some of the industry's most respected figures facing criminal charges, including allegations of fraud. Prominent names such as Sam Bankman-Fried of FTX, Do Kwon, the head of Terraform Labs (parent company of TerraUSD and LUNA), and Su Zhu and Kyle Davies of Three Arrows Capital were among those entangled in legal troubles.

Furthermore, 2022 witnessed the creation of 117,000 fraudulent tokens, resulting in billions of dollars in losses for investors. Initial Coin Offerings (ICOs), particularly those associated with speculative business models, have been widely criticized and often labeled as scams.

The pseudonymous and unregulated nature of blockchain and Bitcoin transactions introduces complications when disputes arise. In traditional centralized transactions, recourse is available in cases of defective goods or services, allowing for transaction cancellations and fund reimbursements. However, the cryptocurrency ecosystem lacks a central authority to facilitate such redress against sellers.

Security and Privacy Concerns

While the blockchain itself is highly resistant to hacking, cryptocurrency exchanges—the venues where digital assets are traded—are more vulnerable to security breaches. Cyberattacks and theft have plagued the market for nearly a decade. The notorious Mt. Gox hack in 2015 saw hackers pilfer approximately 850,000 Bitcoin, and in November 2022, criminals infiltrated FTX, siphoning off $600 million. The previous month, hackers absconded with $570 million from Binance. These attacks, along with others in 2021 and early 2022, resulted in combined losses exceeding $1 billion.

Smart contracts, a hallmark of blockchain technology, are not immune to security breaches. In one of the most significant digital heists in history, a hacker siphoned off $613 million from Poly Network in 2021. This decentralized finance (DeFi) platform facilitated peer-to-peer transactions across blockchains. The theft exploited a vulnerability in the smart contract responsible for automating token transfers. Despite the hacker eventually returning the funds, claiming to have exposed the vulnerability, this incident underscored the substantial risks inherent to such platforms and their users.

Ransomware attacks represent another perilous facet of the cryptocurrency landscape, with hackers infiltrating user accounts, encrypting their data, and demanding cryptocurrency payments as extortion.

Environmental Impact

Cryptocurrencies that rely on proof-of-work consensus mechanisms, such as Bitcoin, consume staggering amounts of energy. In contrast, proof-of-stake tokens, like Ethereum following its transition in 2022, have significantly lower energy footprints. Ethereum, for instance, claims to consume 99.9% less energy post-transition. According to a US government fact sheet from August 2022, cryptocurrency is estimated to consume between 120 and 240 billion kilowatt-hours annually, exceeding the electricity consumption of certain countries and contributing to global climate change.

Additionally, cryptocurrency mining operations have strained power grids in various nations, resulting in significant electricity disruptions, including cases in Iran and Kosovo.

Responsibility, Regulation, and Oversight

The global nature of cryptocurrency technology transcends political borders, limiting the influence of national regulators. To address this challenge, global regulatory bodies like the Financial Stability Board and the International Monetary Fund have collaborated to formulate a unified global regulatory framework, with new regulations expected by September 2023.

Several individual nations have taken independent action due to concerns about environmental impact or criminal activities. Some countries, including China, Egypt, Iraq, Morocco, Algeria, and Tunisia, have outright banned the issuance or possession of cryptocurrencies. An additional 42 countries have implemented restrictions, either prohibiting cryptocurrency exchanges or imposing stringent limitations on the involvement of banks in cryptocurrency transactions. Conversely, certain nations have endeavored to attract companies to establish cryptocurrency markets.

Notably, countries like Japan, Switzerland, and the United Arab Emirates have introduced new legislation or amended existing laws between September 2022 and January 2023. Switzerland's framework, in particular, has been lauded as one of the most mature to date, and the UAE established the world's first authority solely dedicated to virtual currencies. In contrast, countries such as Canada, the UK, and Australia are in the process of drafting cryptocurrency-related legislation, with the European Union nearing the enactment of similar regulations.

In the United States, Congress has intensified its oversight of cryptocurrencies in recent years, with events such as the FTX collapse likely to trigger further scrutiny. Nevertheless, the fundamental challenge lies in regulating an asset class specifically designed to circumvent governmental controls, leaving the success of regulatory efforts uncertain.

Why Do Investors Embrace Cryptocurrency?

Despite the multifaceted challenges associated with cryptocurrency, it continues to exert a powerful appeal on investors for various reasons:

- Speculative Opportunities: Cryptocurrency's inherent price volatility attracts investors seeking to profit from market fluctuations.

- Unique Features: Cryptocurrencies offer qualities such as decentralization, security, and a degree of anonymity not typically associated with traditional currencies. While these attributes remain largely theoretical for now, enthusiasts anticipate the emergence of faster, more affordable transactions, enhanced security and privacy, and greater financial inclusion, which could drive mainstream adoption.

- Geopolitical Hedge: Cryptocurrencies serve as a hedge against geopolitical turmoil, often appreciating in value during periods of political and economic uncertainty. For instance, Bitcoin witnessed a surge in adoption during Brazil's political upheaval in 2015.

- Pseudonymity: Cryptocurrencies provide pseudonymity, enabling users to conduct transactions without divulging personal information to merchants. However, transactions may still be subject to anti-money laundering (AML) regulations, and some trading platforms require customers to undergo "know your customer" (KYC) verification, which can be used by law enforcement to trace transactions.

- Smart Capabilities: Cryptocurrencies with smart contract functionality introduce programmability and advanced features within blockchain and cryptocurrency protocols. These features include NFTs, fractional ownership of assets, privacy-enhancing mechanisms, and automated self-executing agreements that eliminate the need for intermediaries in various industries, such as supply chain management.

- Peer-to-Peer Transactions: Cryptocurrencies facilitate peer-to-peer (P2P) transactions, reducing the risk associated with centralized exchanges. P2P transactions offer greater privacy, lower fees, and a broader range of payment methods, provided users safeguard their information.

What to Understand Before Investing in Cryptocurrency

Cryptocurrency transcends conventional notions of digital money, making it crucial for investors to grasp its intricacies. The experiences of NFT owners in 2021, who found themselves with limited control over purchased art, underscore the need for a thorough understanding of cryptocurrency before investing.

What Is Cryptocurrency?

Cryptocurrency constitutes a digital asset secured through cryptographic techniques. While primarily used for buying and selling goods and services, some cryptocurrencies offer additional functionalities. Most cryptocurrencies lack backing by tangible assets like gold and are not considered legal tender. They are typically issued by private entities.

However, exceptions exist. Stablecoins, for instance, are pegged to assets like the US dollar, gold, or other cryptocurrencies. Several countries, including Nigeria and the Bahamas, have even issued digital currencies via their central banks. Initial Coin Offerings (ICOs) are another facet, enabling firms to raise funds for blockchain and cryptocurrency projects by offering digital tokens to investors.

As of 2023, it is estimated that approximately 420 million individuals worldwide own cryptocurrencies.

Types of Cryptocurrencies

Cryptocurrencies fall into two major categories: coin-only currencies, exemplified by Bitcoin, primarily designed for transactions, and tokens like Ethereum, which serve as the foundation for NFTs and smart contracts.

- Bitcoin: Launched in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin reigns as the most renowned cryptocurrency, commanding a market share of around 45%. Bitcoin transactions involve the transfer of payments between mobile wallets, and its acceptance among merchants has grown. Nevertheless, Bitcoin has limitations, including processing speed and a lack of support for smart contracts and decentralized applications (DApps). Its price history is marked by substantial fluctuations, influenced by various factors.

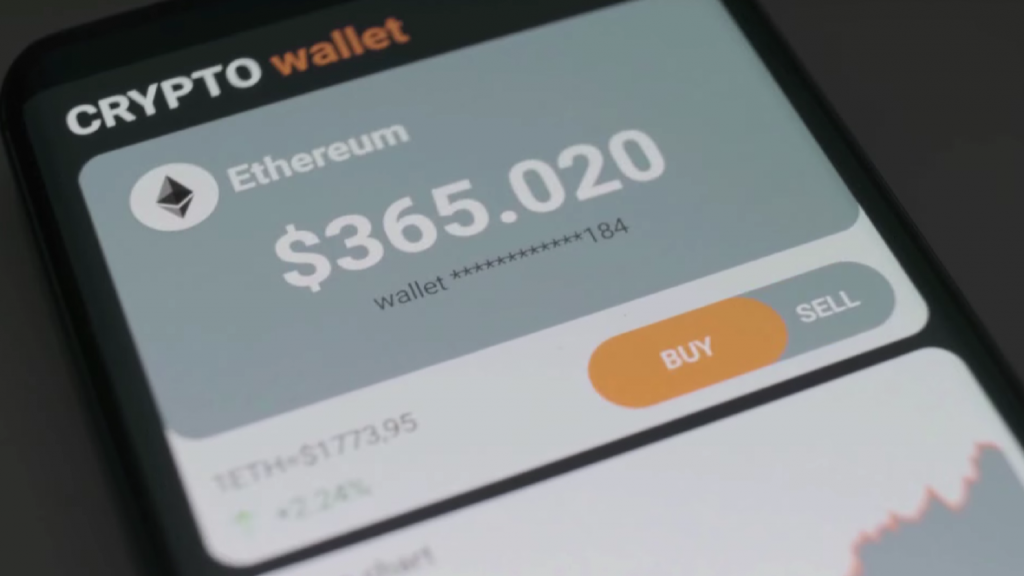

- Ethereum and Ether: Ethereum, a blockchain platform, facilitates the creation of smart contracts, with Ether serving as the token used for transactions on the Ethereum network. Ethereum's market capitalization exceeded $218 billion as of May 2023. While Ethereum has faced technological challenges, its market share has increased over the past two years. Ethereum's significance extends beyond transactions; it introduced smart contract capabilities, spurring innovation in the cryptocurrency landscape.

- Diverse Cryptocurrencies: Beyond Bitcoin and Ethereum, the cryptocurrency universe has expanded over the past decade, with the emergence of numerous digital coins and tokens. These include Litecoin, Zcash, Dash, and Dogecoin, among others. The number of distinct cryptocurrencies now approaches 23,000.

How Does Cryptocurrency Work?

Cryptocurrencies operate on the underlying technology of blockchain. This technology relies on continuously updated public or private ledgers that record all transactions in a decentralized manner, devoid of central authorities such as banks or governments. For any transaction to be validated, it must garner approval from both the buyer and seller, with a third entity, often termed a "miner" or "validator," securing the blockchain. Altering transaction information requires unanimous consent, and consensus mechanisms dictate the validation process, which varies depending on the blockchain's chosen method.

In the case of proof-of-work, utilized by Bitcoin and other cryptocurrencies, miners must solve complex cryptographic puzzles to verify transactions. The first miner to solve the puzzle receives a cryptocurrency reward. While anyone with sufficient computing power can engage in mining, the costs and complexity involved necessitate the use of multiple computers and mining pools to compete effectively.

Ethereum, in contrast, transitioned to a less energy-intensive consensus mechanism known as proof-of-stake in September 2022. Validators in this system stake a portion of their own coins to participate in transaction validation. Upon successful validation, validators earn transaction fees. This approach eliminates the energy-intensive competition seen in proof-of-work, offering cost savings and reduced emissions.

How Is Cryptocurrency Utilized?

While cryptocurrency ATMs exist in public spaces, most cryptocurrency transactions transpire online through exchanges and wallets.

Cryptocurrency Exchanges: Cryptocurrency exchanges serve as online platforms where individuals can buy, sell, or trade cryptocurrencies, either for other digital currencies or traditional fiat currencies. These exchanges can facilitate conversions between different cryptocurrencies as well. Leading exchanges, such as Binance, Coinbase Exchange, Kraken, and KuCoin, handle daily trading volumes exceeding $10 billion. Many reputable exchanges comply with anti-money laundering (AML) and know your customer (KYC) requirements, but decentralized exchanges provide greater anonymity at the expense of increased risk.

Cryptocurrency Wallets: Cryptocurrency wallets enable users to interact with blockchain networks by generating and storing private and public keys. Public keys function as addresses for receiving funds, while private keys authorize transactions. Wallets do not hold cryptocurrencies but safeguard the keys, as the actual assets are stored on public blockchain networks. Wallets can be hardware or software-based, with hardware wallets generally considered more secure but less user-friendly.

Factors Influencing Cryptocurrency Prices

Cryptocurrency prices differ from those of traditional currencies, and several factors affect their valuation:

- Supply and Demand: Bitcoin, for instance, has a maximum supply of 21 million tokens, with over 19 million already mined. Increased adoption amid limited supply growth can drive up prices. However, various cryptocurrencies employ unique tokenomics that dictate their total supply and issuance models.

- Applications: Cryptocurrencies gain value by serving as mediums of exchange and improving upon existing models, as seen with Ethereum's introduction of smart contracts and additional functionalities.

- Regulatory Changes: Cryptocurrency prices often hinge on expectations of future regulatory developments. Increased regulation can impact prices significantly, with regional disparities in regulatory approaches further influencing price dynamics.

- Technological Advancements: Changes in underlying technology, such as upgrades or shifts in consensus mechanisms, can affect cryptocurrency prices. Notable examples include Bitcoin's Segregated Witness (SegWit) upgrade and Ethereum's transition to proof-of-stake.

- Investor Behavior: Cryptocurrency prices can experience bubbles driven by supply constraints, demand surges, and speculative fervor. Fraudulent schemes, pump-and-dump tactics, and exit scams can artificially inflate prices, leading to eventual declines.

Taxation of Cryptocurrency

Cryptocurrency taxation varies by jurisdiction. In the United States, the IRS categorizes digital assets as personal property, subjecting them to tax obligations akin to property transactions. The value of cryptocurrency holdings on a balance sheet is typically determined by their fair market value at the time of acquisition.

Outside the U.S., taxation approaches vary. In Europe, for instance, a 2015 ruling from the European Court of Justice exempted cryptocurrency transactions from taxes on purchases and sales. However, recent proposals from the European Parliament suggest introducing taxes on capital gains, transactions, and mining.

Japan reclassified cryptocurrencies as a "means of settlement" in 2017, exempting them from the 8% consumption tax.

The Cryptocurrency Challenge

As cryptocurrency enters its fifth year since the 2017-2018 heyday, it remains a divisive subject. Some, like Warren Buffett, view it as ingenious but ultimately a delusion, while others, like Bill Miller, maintain bullish sentiments. Cryptocurrency represents a fintech phenomenon, offering the potential to reshape political, economic, and societal foundations.

Regardless of cryptocurrency's future fortunes, the underlying blockchain technology holds transformative power across various industries, from banking and cybersecurity to voting, academia, and supply chain management. Financial analysts predict that the global blockchain technology market will generate revenues nearing $1.24 trillion by 2030, a substantial increase from $5.85 billion in 2021.

The ultimate challenge for crypto-enthusiasts lies in harnessing the technology's full potential while fostering public confidence in the cryptocurrency market to achieve widespread adoption.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.