Some of the leading online banking platforms offer low fees, high interest rates offer low fees, high interest rates and convenient features for their customers. In this article, we will compare these four platforms and highlight their pros and cons.

What We'll Cover

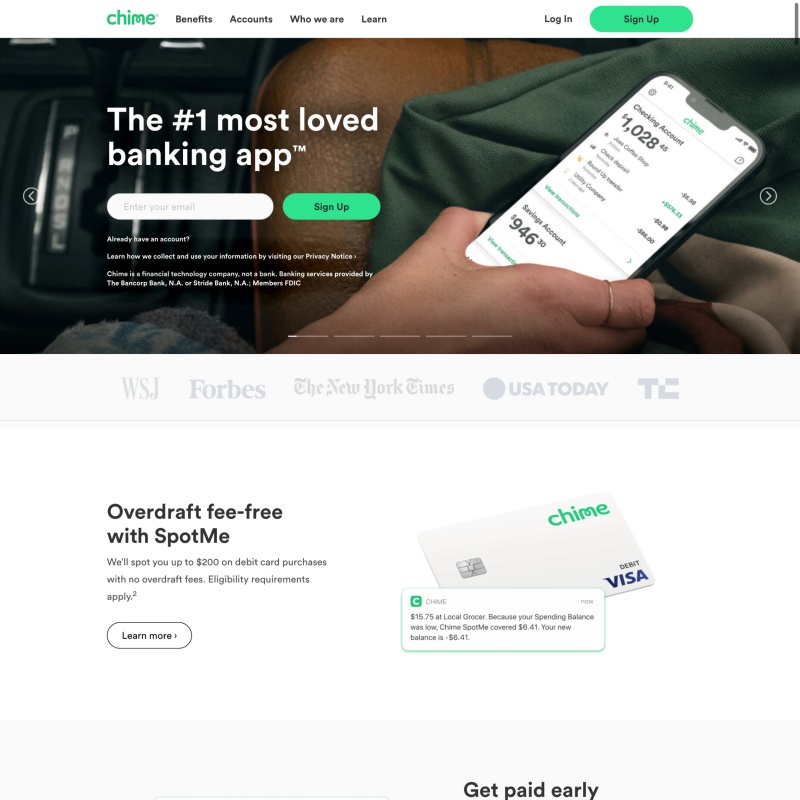

Chime

Is a financial technology company that provides online banking services through its partner banks, The Bancorp Bank and Stride Bank. Chime offers a checking account, a savings account, and a debit card with no monthly fees, no minimum balance requirements, and no overdraft fees. Chime also has some unique features, such as:

- SpotMe: A fee-free overdraft protection program that lets you overdraft up to $200 on debit card purchases, depending on your eligibility and direct deposits.

- Get paid early: A feature that allows you to receive your paycheck up to two days earlier than your co-workers, if you set up direct deposit with Chime.

- Save when you spend: A feature that automatically rounds up your debit card transactions to the nearest dollar and transfers the difference to your savings account.

- Save when you get paid: A feature that automatically transfers 10% of your paycheck to your savings account, if you set up direct deposit with Chime.

- Access to paychecks up to 2 days early with direct deposit

- Fee-free overdrafts up to $200 with SpotMe

- Automatic savings tools that round up transactions and transfer money to savings

- 60,000+ fee-free ATMs nationwide

- No physical branches or checkbooks

- No joint accounts or CDs

- Checking account required to open a savings account

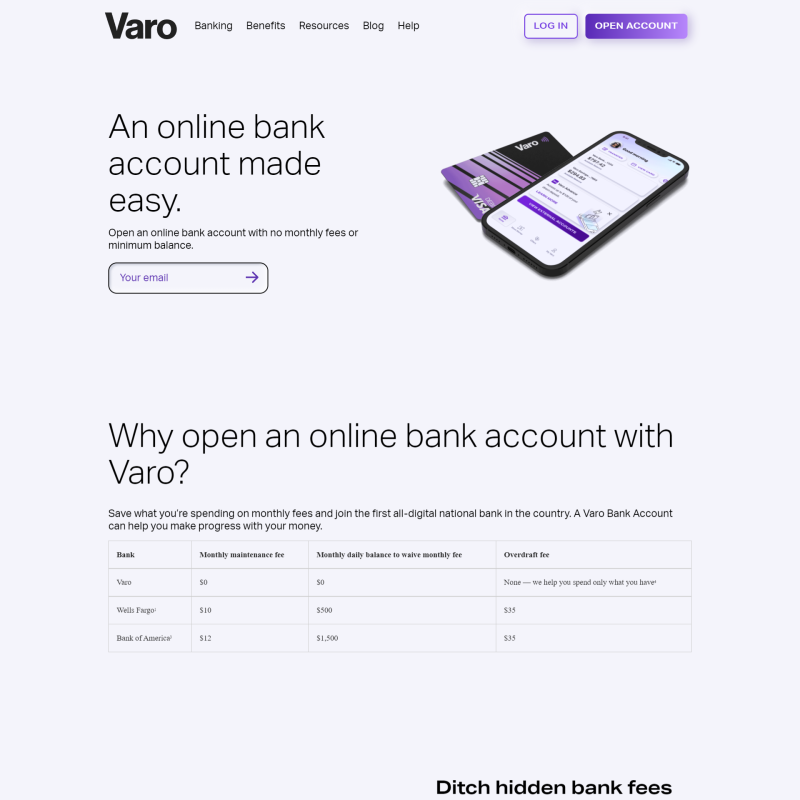

Varo Bank

Is an online-only bank that offers a checking account, a savings account, and a credit builder card. Varo Bank is the first consumer fintech to receive a full-service bank charter, which means it operates independently from its partner bank, Coastal Community Bank. Varo Bank also has no monthly fees, no minimum balance requirements, and no foreign transaction fees. Some of the features that Varo Bank offers are:

- Varo Advance: A cash advance program that lets you borrow up to $250 instantly, depending on your eligibility and direct deposits. You can repay the advance with a small fee within 30 days.

- Varo Believe: A secured credit card that helps you build credit with no interest, no annual fees, and no credit check to apply. You can set your own credit limit by depositing money into a linked savings account, and you can increase your FICO score by an average of 30 points in three months, according to Varo Bank.

- High-yield savings: A savings account that offers up to 5.00% APY on balances up to $5,000, if you meet certain requirements, such as receiving at least $1,000 in direct deposits and using your Varo debit card at least five times per month. Any amount above $5,000 will earn 3.00% APY.

- Cash back rewards: A program that lets you earn cash back on your purchases at select merchants, such as Walmart, Netflix, and Starbucks. The cash back is automatically deposited into your savings account, and you can earn up to 10% cash back on your first Walmart purchase within the first month of sign-up, if you join Varo Bank through its website.

- High APY of up to 3% on savings accounts with qualifying activities

- No monthly fees, minimum balance requirements, or foreign transaction fees

- Cash deposits at over 90,000 retail locations

- Access to paychecks up to 2 days early with direct deposit

- No physical branches or checkbooks

- No joint accounts or CDs

- Limited customer service hours

One Finance (One)

One Finance, also known as One, is a fintech entity offering virtual banking services via its associate, Coastal Community Bank. It features a versatile account that permits the segregation of funds into various categories, termed 'Pockets', for distinct financial activities like saving, spending, and sharing. One's services come without monthly charges, minimum balance stipulations, or overdraft fees. Key offerings include:

- 5.00% APY on Savings: Earn up to 5.00% APY on amounts up to $100,000 annually, provided you receive minimum direct deposits of $500 or maintain a minimum balance of $5,000. This feature also allows the creation of multiple Pockets for diverse saving objectives and facilitates easy transfers among them.

- Cash Advance: Qualifying users can instantly access up to $250 based on eligibility and direct deposit history, repayable interest-free within 30 days.

- Pay Anyone: This functionality enables instant money transfers between One account holders at no additional cost. It also supports the creation of shared Pockets for collaborative financial management with friends and family.

- Cash Back Offers: Gain cash rewards on purchases at selected brands, including Walmart, Target, and Uber. Rewards are directly credited into your savings Pockets. Special offers include up to 10% cash back on initial Walmart purchases within the first month of signing up via the One website.

- High APY of up to 3% on savings accounts with qualifying activities

- No monthly fees, minimum balance requirements, or overdraft fees

- Cash deposits at over 55,000 retail locationsShared accounts with family and friends

- No physical branches or checkbooks

- No CDs or personal loans

- Limited customer service hours

Ally Bank

Ally Bank is an online-only bank that offers a variety of products and services, such as checking accounts, savings accounts, money market accounts, CDs, IRAs, mortgages, auto loans, personal loans, and investing. Ally Bank is a subsidiary of Ally Financial, a leading digital financial services company that was founded in 1919. Ally Bank has no monthly fees, no minimum balance requirements, and no foreign transaction fees. Some of the features that offers are:

- High-yield savings: A savings account that offers 4.25% APY on all balance tiers, with no transaction limit and unlimited deposits. You can also organize and maximize your savings using buckets and boosters, which are tools that help you create sub-accounts for different savings goals and automate your savings transfers.

- Interest checking: A checking account that offers 3.00% APY on balances of $15,000 or more, and 2.00% APY on balances less than $15,000. You can also access your money at any time, including by debit card and checks, and get up to $10 in ATM fee reimbursements per statement cycle.

- No penalty CD: A CD that offers 5.15% APY on all terms, with no minimum deposit required and no early withdrawal penalty. You can withdraw your full balance and interest earned any time after the first six days following the date you fund your account.

- Ally Invest: An online investing platform that offers self-directed trading, robo portfolios, and personal advice. You can trade stocks, ETFs, options, and more with $0 commissions, or choose a diversified portfolio of ETFs that is managed by Ally Invest’s team of experts, with no advisory fees. You can also get personalized guidance from a dedicated financial consultant, with a low annual fee of 0.30%.

- Competitive APYs on all accounts

- No monthly fees or minimum balance requirements

- 24/7 customer service

- Multiple CD options with no early withdrawal penalty

- No physical branches or cash deposits

- Foreign transaction fees of up to 1%

- Lower APY on checking account compared to other platforms

Conclusion

Online banking is a great way to manage your money with convenience, security and advantages. Whether you're looking for a simple, fee-free banking solution, a high-yield savings account, a credit card or a diversified investment platform, there's an online banking option to suit your needs. Each of these platforms has its own strengths and features, and you can choose the one that best suits your preferences and goals. You can also open an online account on any of these platforms in a matter of minutes and enjoy the benefits of online banking.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.